NEWS

NEWS

In accordance with the Chinese Tax Law, from 2020, every tax resident of China shall be required to declare the gross individual income of the previous year (hereinafter referred to as “annual declaration” ). Recently, we have received a lot of inquiries from foreigners on annual declaration. Hereby, we are going to give a guidance and share the policy of subsidizing foreign individuals working in the Great Bay Area.

Declaration Period

Declaration period is from March 1st to June 30th. However, for sake of the epidemic crisis, 2020’s annual declaration has not start, and the Chinese government has not yet announced the specific date of the declaration.

APP for the Annual Declaration

The annual declaration APP “Individual Income Tax” can be download in your mobile phone as below, but at present, just Chinese version is available.

Person who Need to Declare

If there is a bilateral tax treaty between the country of nationality of the foreigner and China, the foreigner may submit the following filing forms and relevant documents to the China Tax Bureau in order not to be identified as a Chinese resident taxpayer.

Only those foreigners who are considered as the tax resident of China, according to Chinese tax law, foreigners who have resided in China for more than 90 days will become Chinese resident taxpayers, are required to do the annual declaration.

Incomes Shall be Declared

1. Income from salaries and wages

2. Income from remuneration for personal services, such as doing part time job

3. Income from author’s remuneration

4. Income from royalties

Not all of the above will be taxed in China. The China Tax Bureau will determine the tax base and calculate the tax in accordance with the Chinese Tax Law.

The Influence of Annual Declaration

Due to the tax base for calculating the withholding tax is different from the tax base for calculating the final income tax based of the year, the difference occurs when an individual gains multiple income and when the tax status of a foreigner switch from tax resident to non-resident or vise verse. The annual declaration may lead to reimbursement or refund.

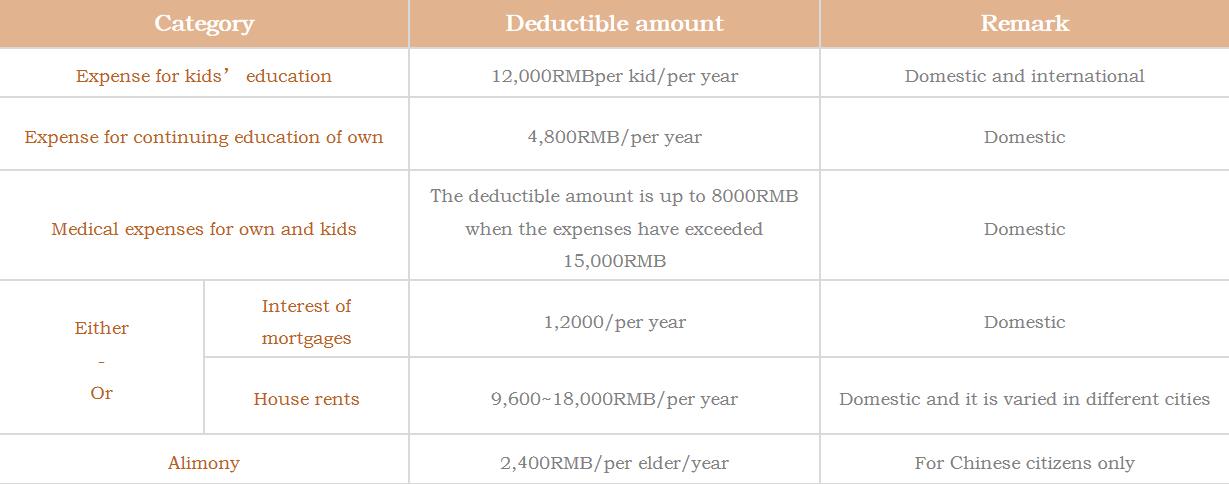

Deductible Items before Annual Declaration

If your income already includes certain tax-free allowances (which your HR should be aware of), these items will no longer be declared.

Subsidies for Foreigners Working in the Great Bay Area

Working in the Great Bay Area means working in Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen or Zhaoqing of Guangdong Province.

Foreign talents, recognized by the local Administration of Foreign Expert Affairs or the local Municipal Human Resources & Social Security Bureau, can apply for the subsidies which is equal to the income tax payment exceeding 15% of the taxable income.

[Reference: New Individual Income Tax Preferential Policies in Greater Bay Area]

- Team Members -

Anita Wang

Partner in the Tax Department

Practicing on Finance and Tax

Working language: Chinese and English

Email:wanglingru@zlwd.com

Zoraida Liang

Partner in Latin Department

Practicing on International Investment and Trading

Working language: Chinese, Spanish and English

Email:Liangxinyue@zlwd.com