NEWS

NEWS

This Final Year Project research investigated the surrogate methodology used in the European Union (EU) anti-dumping measures, based on the Regulation (EU) 2017/2321. The question was whether the methodology is compatible with EU commitments under the WTO framework. The issue has a relevance, since this methodology is typically applied in EU-China trade. My research focused on the WTO legal documents and especially on an analysis of a specific case of Argentina v. EU (WT/DS473). I found the EU's anti-dumping practices under the new surrogate methodology may fail to comply with the WTO framework if the Dispute Settlement Body’s interpretation is consistently applied.

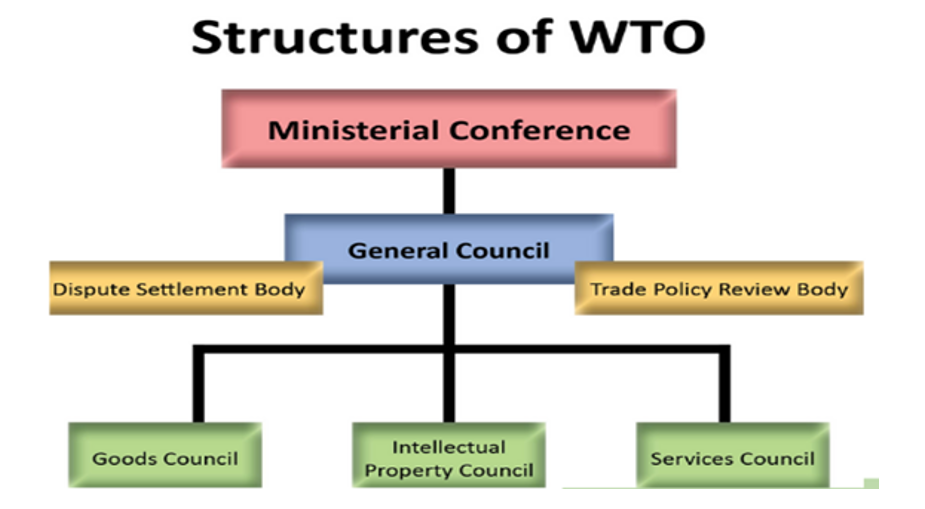

The World Trade Organization (WTO) is an international organization established in 1995 to succeed the General Agreement on Tariffs and Trade (GATT) in its ambition to “help trade flow as freely as possible.” With 164 member countries the WTO is a pillar of current international trade regime. At its heart are trade rules based on negotiated and signed binding agreements, while the WTO provides a platform for negotiation and neutral procedures for dispute settlement between trading nations. (WTO 2022a)

The WTO provides a mechanism for independent quasi-judiciary proceedings to settle disputes regarding interpretation of the agreed-on trade rules. A dispute is initiated when a government charges another for noncompliance at the WTO Dispute Settlement Body (DSB). If preliminary consultations fail, the DSB proceeds by creating a specialized panel and formal proceedings, including investigation of the evidence. The panel’s final report is then adopted by the DSB. If found in non-compliance, and after the government in question used its right to appeal, the targeted policy must be changed. (Oatley 2019, p. 102-103)

If a company exports a product at a price lower than the price it normally charges on its own home market, it is said to be “dumping” the product.” (WTO 2022b) The WTO rules allow governments to act and apply anti-dumping measures where genuine injury is done to domestic industry.

Under the WTO framework three methods are suggested to find “normal price”, and to identify dumping in each case. (1) Comparison with the price on the exporter’s domestic market. (2) Comparison with the price charged by the exporter in another country. (3) A calculation combining the exporter’s production costs, other expenses and normal profit margins. (WTO 2022c)

Upon its accession to the WTO in 2001, the People’s Republic of China in the Protocol of Accession accepted that in view of the special circumstances of its economy, anti-dumping investigations concerning Chinese exporters may use the so-called “surrogate methodology:” unless the producer can prove that market economy conditions prevailed in his sector of domestic economy, the investigation would use prices in a “surrogate,” reasonably similar country.

Regulation (EU) 2017/2321 modified the existing surrogate methodology for "non-market economies" and replaces it with one based on "significant distortion." It authorizes the European Commission to use the surrogate methodology when there is "market distortion" in the exporting country. According to article 2 (b), "significant distortion" means that "the reported prices or costs, including the costs of raw materials and energy, are not the result of free market forces because they are affected by substantial government intervention". (EU Council, 2017)

When the EU determines that there is "significant distortion" in the domestic market of the product of the exporting country, external prices shall be used as the standard for determining the cost of the production and sale or the price of the product and thus its normal value. The estimates of external prices come from two sources: (1) appropriate, undistorted international price, cost, or benchmark, and (2) corresponding cost of production and sale of the product in a third country other than the importing and exporting country, or the domestic sales price in the third country. (EU Council, 2017)

2001 China officially became WTO's member

2016 Expiry of Section 15(a)(ii) of the Protocol on the Accession of the People's Republic of China

2016 China sued the EU at WTO (DS516 European Union — Measures Related to Price Comparison Methodologies)

2017 The European Union published Regulation 2017/2321 of the European Parliament and of the European Council

2019 The WTO issued a communication announcing that the panel proceedings in case DS516 had been suspended at the request of China

Position 1: It is compatible with the WTO framework.

Article 6 of GATT and Article 2 of the Anti-Dumping Agreement stipulate that the normal value can be determined by the price of a third country without considering the domestic price, which has certain legitimacy in terms of its formation process and determination form. First of all, the provisions of the treaty make the agreements reached in the course of continuous negotiations and consultations among member states legally binding. Second, when the treaty was established, the original intention of member states was to encourage free trade between market economies, with the assumption that there would be no high degree of state monopoly in each economy. Thus, the EU have found the legal basis in international law from Article 6 of GATT and Article 2 of the Anti-Dumping Agreement to determine the surrogate methodology in the form of domestic law. Formally speaking, EU’s surrogate methodology in its anti-dumping laws does not violate WTO principle.

Position 2: It is not compatible with the WTO framework.

My Argument

In my research, I identified the case of "European Union — Anti-Dumping Measures on Biodiesel from Argentina" (WT/DS473), in which the EU refused to use the production cost data of the investigated company in the anti-dumping investigation on Argentine biodiesel, and instead used the internationally prevailing price data of the raw material (soybeans) directly.

This approach is not fundamentally different from that under the new surrogate methodology. Both the WTO Panel and the Appellate Body unanimously ruled that the so-called "cost adjustment" measures of the EU violated paragraph 2 of Article 2 of the Anti-dumping Agreement, mainly because it explicitly requires the investigating authorities to use the cost data recorded by export enterprises. If the exporter's records do not reasonably reflect its actual costs, the investigating authority may make appropriate adjustments to the data. To put it simply, under paragraph 2 of Article 2 of the Anti-dumping Agreement, if necessary, the investigating authority can adjust the cost data of the investigated export enterprises, but it cannot directly ignore these data and replace them with external data.

Starting from the statute law of WTO, the new surrogate methodology in the amendment of EU has its legal basis. Paragraph 1 of Article 6 of GATT and paragraph 7 of Article 2 of the Anti-Dumping Agreement provide support for it in terms of international law, so that EU does not violate its obligations as a WTO member. However, in judicial practice, WTO shows a tendency not to support and recognize the new surrogate methodology, suggesting that WTO may consider it illegal. Both the WTO Panel and the Appellate Body unanimously ruled that the EU's anti-dumping decision on Argentine biodiesel based on distortions in Argentina's domestic market violated Article 2 (2) of the Anti-Dumping Agreement.

Statutory law and case law are two pillars of common law, but they have contradictory legality judgment on the issue of new surrogate methodology within the WTO system. Given the widespread use of the new surrogate methodology in the EU's current anti-dumping practices against China, the need for further discussion and evidence remains strong.

References:

1. Oatley, Thomas. International Political Economy. 6th Edition. New York and London: Routledge.

2. WTO (2022a) ‘Who we are.’ [online] World Trade Organization. Available at: https://www.wto.org/english/thewto_e/whatis_e/who_we_are_e.htm (Accessed 1 April 2022)

3. WTO (2022b) ‘Anti-dumping.’ [online] World Trade Organization. Available at:

https://www.wto.org/english/tratop_e/adp_e/adp_e.htm (Accessed 1 April 2022)

4. WTO (2022c) ‘Anti-dumping, subsidies, safeguards: contingencies, etc.’ [online] World Trade Organization. Available at:

https://www.wto.org/english/thewto_e/whatis_e/tif_e/agrm8_e.htm (Accessed 1 April 2022)

Guo Lingxiang (Alexandra)

Division of Humanities and Social Sciences

BNU-HKBU United International College